How to Calculate your Digital marketing budget

Updated last on:

April 4, 2023

How much should you invest in digital marketing? Is there a formula? What does it depend on?

by Eric Sharp

TOPICS:

I’m determined to memorize a quick, educated, and sensitive response to this question over the next 12 months.

When prospective clients ask me:

Eric, what would you recommend us spending on digital marketing this year?

My current answer is fueled more by a semi-qualitative viewpoint.

Well Mr. Prospective Client, our existing clients of your size within your vertical usually spend between x to y.

My answer stops there. And that’s the problem. It’s a decent answer, but not good enough.

I want an answer filled with confidence that includes both qualitative and quantitative data.

Ideally, there’s an industry benchmark that everybody uses. If you have 10 Million in Revenues, you should invest 10% into digital marketing. 20 Million? Decrease that by a few percentage points.

But, it’s not that simple. The reality is businesses don’t follow scripts. Every company likes a little bit of math to guide them, but at the end of the day, the threshold for risk is unknown. And that’s where things get sticky when earmarking dollars to marketing. Companies live and die on how much risk they can tolerate (see Jeff Bezos).

But, this idea of risk aversion is not the thing to fully dissect and understand in this journey. The goal is to have a robust answer that clearly sounds like I’ve thought about this before (which will help the Sales process).

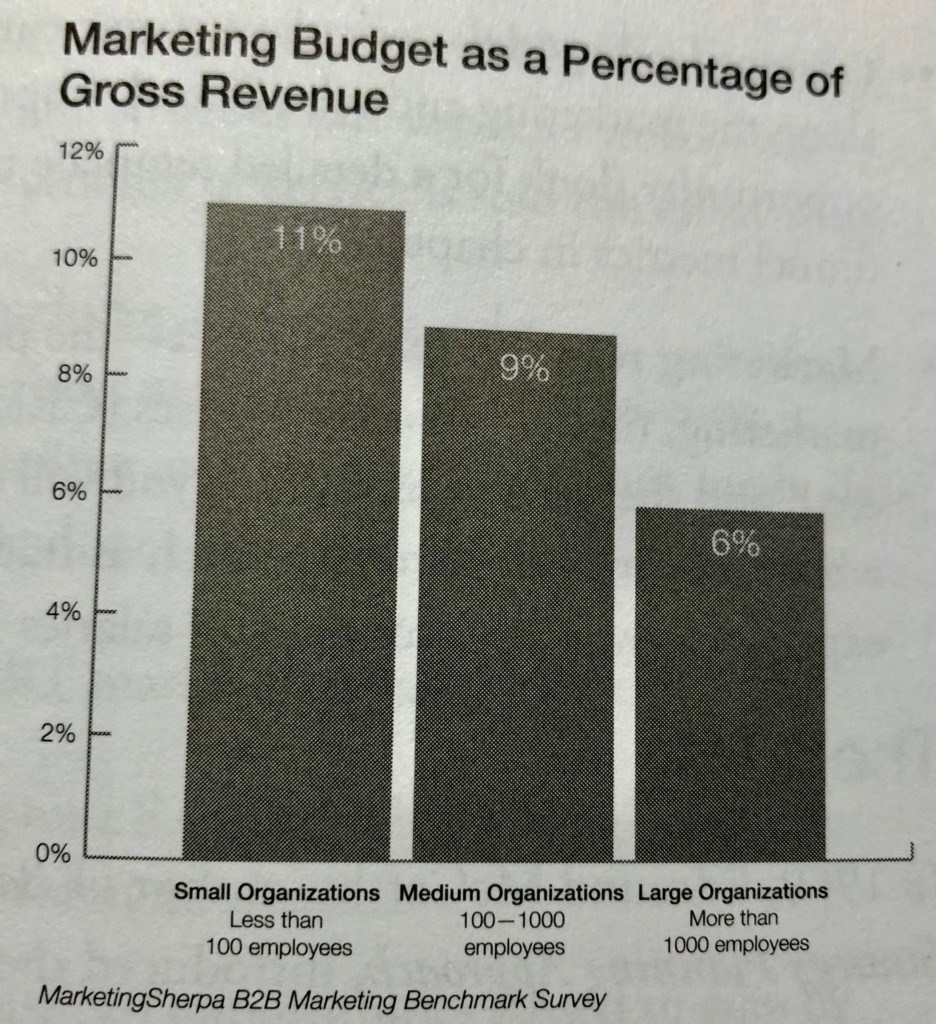

Marketing Budget as a Percentage of Gross Revenue

I’m coming across resources that are clearing the way. One, in particular, is a B2B Marketing Benchmark Survey done by MarketingSherpa (see chart below) that I found in Rebecca Geier’s book, Smart Marketing for Engineers.

The percentage ranges from 6%-11% for the 3 different sizes of business.

I’m better off now than I was before. So, that’s good. But, other factors need exploring:

- Product/Service margins

- Length of Sales Cycle

- Inventory

- State of Economy

- Desire to scale/grow

- Risk aversion (aforementioned)

Need website help?

We're all about websites — especially websites that are loved by people and Google.

Since 2001, we've been helping clients nationwide turnaround their outdated and under-performing websites.

"Our website is generating quality leads every week thanks to their website consulting."

Steve L.

Cactus Technologies

Hey, you made it!

There is gobs of information available today — I'm honored you found this article interesting enough to make it here. I hope this insight leads you to a better-performing website!

About the Author

Eric Sharp is the founder of ProtoFuse and has been in the website trenches since 1999 — right before the dot-com boom redefined the website landscape. Since then, he's accumulated 25 years of digital marketing experience and prides himself on creating websites "Loved by people and Google". Outside of websites, it's all about fam time with his wife and 2 kids. He enjoys CrossFit, cooking steak on his cast iron skillet, collecting Jordan sports cards, and Daaa Bears.